Financial inclusion stands as a cornerstone for fostering economic growth, particularly in countries like Indonesia, with a vast population, a significant portion of which falls within the productive age group. Despite the strides made, there are still segments of society, notably gig workers and MSMEs, that remain underserved in accessing financial services.

The emergence of fintech lending, including peer-to-peer (P2P) platforms and Buy Now Pay Later (BNPL) solutions, has heralded a digital revolution in the financial landscape. However, the capacity of these platforms to cater to the unbanked population, especially in providing substantial loans, remains somewhat constrained.

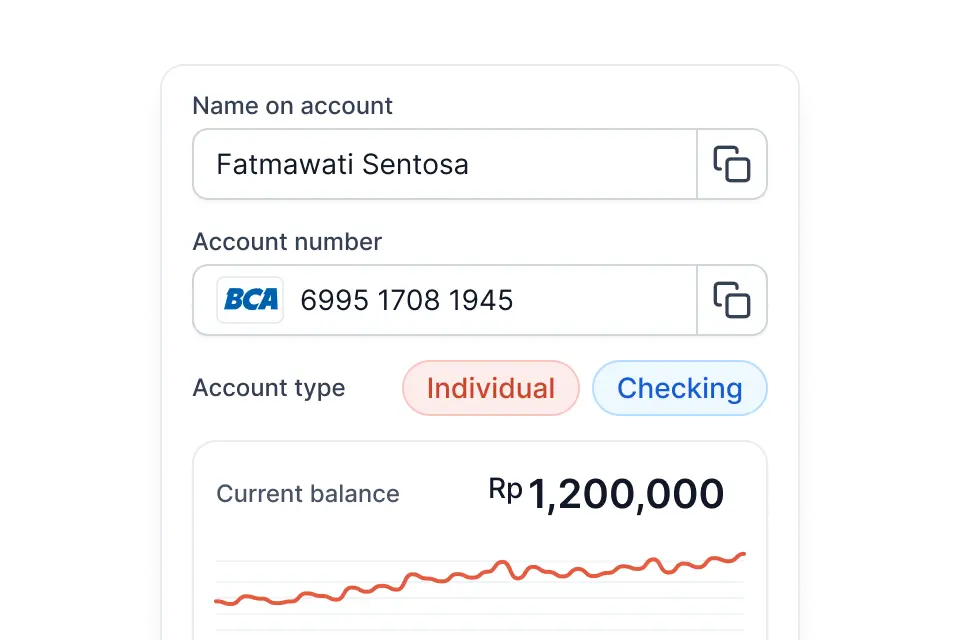

One of the primary challenges lies in credit scoring, a critical component of the lending process. Traditional credit scoring methods often fall short in assessing the creditworthiness of individuals lacking a formal credit history or collateral. As a result, gig workers and MSMEs, who may possess strong earning potential but lack conventional financial records, find themselves excluded from accessing credit.

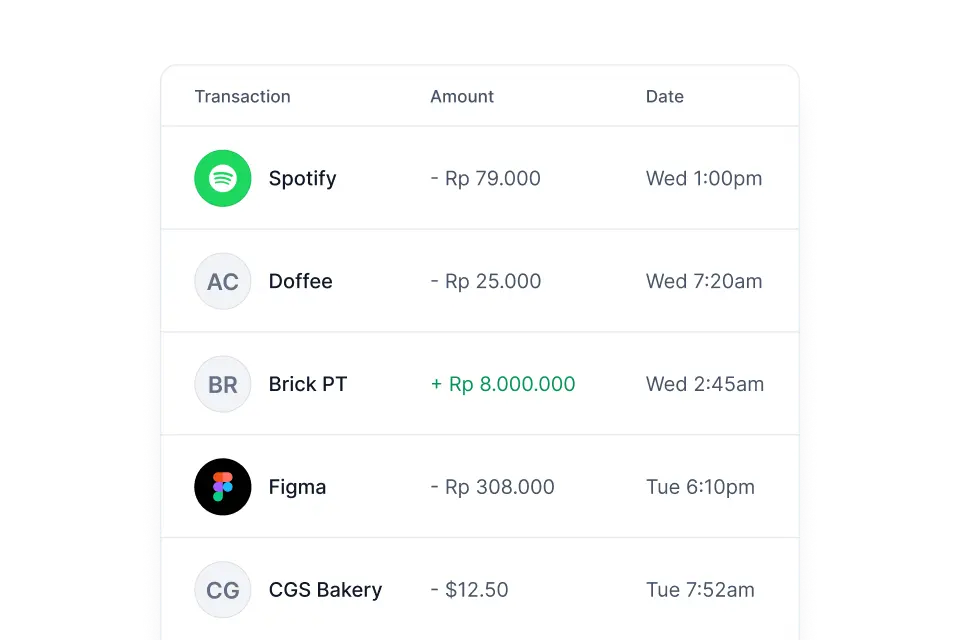

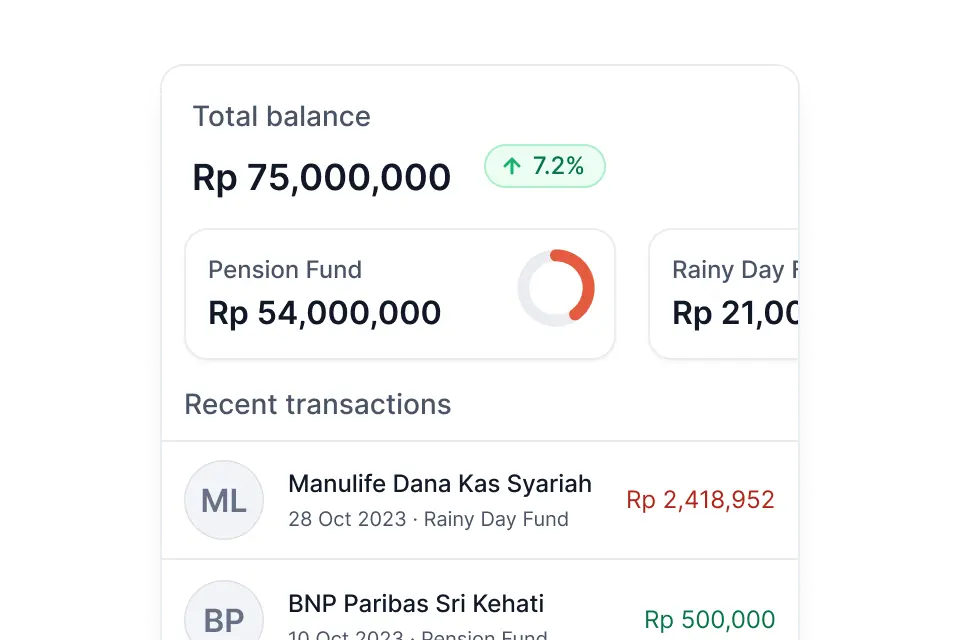

To address this gap, innovative credit scoring methods are being pioneered by fintech companies, leveraging alternative data sources and advanced analytics. By harnessing non-traditional data such as transaction history, social media activity, and mobile phone usage patterns, these companies are developing more holistic and inclusive credit assessment models.

These innovative approaches have the potential to unlock greater financial inclusion by expanding access to credit for underserved segments of society. By accurately assessing credit risk and providing tailored financial solutions, fintech lenders can empower gig workers and MSMEs to seize opportunities for growth and prosperity.

However, as with any transformative initiative, challenges remain. Ensuring the accuracy, reliability, and fairness of alternative credit scoring models is paramount to building trust and credibility. Moreover, collaboration with regulatory authorities is essential to navigate the regulatory landscape and ensure compliance with consumer protection laws.

In conclusion, innovative credit scoring methods hold the key to unlocking economic growth by fostering greater financial inclusion in Indonesia. While challenges persist, the ongoing efforts of fintech lenders to develop inclusive lending solutions signal a promising future where all segments of society can participate in and benefit from the digital financial revolution.